Some Of Best Personal Loans

Wiki Article

The Ultimate Guide To Best Personal Loans

Table of ContentsSome Known Details About Loan Apps Some Known Incorrect Statements About Instant Loan A Biased View of $100 Loan Instant AppUnknown Facts About Instant LoanThe Buzz on $100 Loan Instant AppFascination About Best Personal Loans

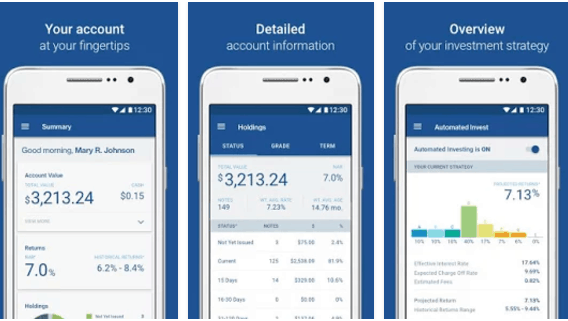

When we think of making an application for lendings, the imagery that enters your mind is individuals aligning in lines up, awaiting many follow-ups, as well as obtaining utterly frustrated. But modern technology, as we understand it, has changed the face of the loaning service. In today's economic situation, debtors and also not lending institutions hold the trick.Car loan approval and also paperwork to funding processing, whatever is online. The numerous relied on online loan applications use debtors a platform to request financings conveniently and also offer approval in mins. You can take an from a few of the very best cash loan applications available for download on Google Play Shop and Application Shop.

You just need to download the app or go to the Pay, Sense internet site, sign up, submit the required files, as well as your loan will get authorized. You will certainly obtain alerted when your finance request is processed. Commonly car loan application utilized to take at least a couple of days. Sometimes, the lending authorization utilized to obtain extended to over a month.

The Only Guide for Instant Cash Advance App

Usually, even after getting your loan accepted, the process of obtaining the car loan quantity transferred to you can take time as well as get made complex. That is not the instance with on the internet car loan apps that provide a straight transfer alternative. Immediate loan apps supply instant individual car loans in the series of Rs.

5,00,000 - instant cash advance app. You can get an instantaneous finance as per your qualification as well as require from instant finance apps. You do not have to fret the following time you desire to make use a small-ticket car loan as you understand exactly how helpful it is to take a lending using on the internet financing applications. So, do away with the lengthy as well as tiring procedure of get standard personal loans.

Instant Loan Can Be Fun For Anyone

You can be certain that you'll obtain a reasonable rate of interest, tenure, lending quantity, as well as other benefits when you take a financing with Pay, Feeling Online Financing Application.A digital lending system covers the whole financing lifecycle from application to dispensation right into consumers' checking account. By digitizing and automating the financing procedure, the system is changing standard financial institutions right into digital loan providers. In this write-up, allow's check out the benefits that a digital borrowing platform can bring to the table: what remains in it for both financial institutions as well as their customers, as well as how electronic loaning platforms are interfering with the market.

They can also scan the financial institution statements for information within just secs. These functions aid to guarantee a rapid and hassle-free user experience. The digital banking landscape is currently more dynamic than ever before. Every financial institution now wants every little thing, including financings, to be processed instantly in real-time. Clients are no much longer happy to wait on days - and also to leave their homes - for a financing.

The Basic Principles Of Best Personal Loans

All of their day-to-day tasks, consisting of financial transactions for all their activities and they prefer doing their financial transactions on it too. They want the convenience of making transactions or applying for a lending anytime from anywhere - $100 loan instant app.In this situation, electronic borrowing platforms serve as a one-stop option with little hand-operated information input and also quick turnaround time from financing application to cash in the account. Clients need to have the ability to relocate flawlessly from one tool to an additional to finish the application, be it the internet and also mobile user interfaces.

Service providers of digital lending systems are required to make their products in compliance with these regulations and also assist the loan providers concentrate on their organization only. Lenders additionally has to ensure that the carriers are updated with all the newest standards provided by the Regulators to quickly include them into the digital borrowing platform.

An Unbiased View of Best Personal Loans

As time passes, digital financing systems can assist in saving 30 to 50% overhead costs. The conventional manual get redirected here lending system was a discomfort for both lender as well as consumer. It relies upon human treatment and physical communication at every action. Customers needed to make multiple journeys to the banks as well as submit all sort of papers, and by hand complete a number of kinds.The Digital Lending system has actually changed the method financial institutions think of and execute their loan procurement. Financial institutions can currently deploy a fully-digital financing cycle leveraging see this website the most up to date technologies. A wonderful digital financing system must have simple application submission, fast approvals, certified lending procedures, and also the capacity to constantly enhance procedure performance.

If you're believing of going into lending, these are comforting numbers. At its core, fintech is all concerning making conventional economic procedures quicker as well as much more efficient.

Not known Facts About Instant Cash Advance App

One of the common misunderstandings is that fintech apps only benefit financial establishments. The application of fintech is currently spilling from financial institutions and loan providers to little businesses. $100 loan instant app., CEO of the payment system Veem, sums it ideal: "Little companies are looking to contract out intricacy to someone else since they have sufficient to worry around.As you can see, the simplicity of usage covers my review here the list, showing exactly how accessibility as well as benefit given by fintech platforms represent a huge motorist for client commitment. You can apply numerous fintech advancements to drive client count on and also retention for businesses.

Report this wiki page